To Employers

The information contained in the Employer Handbook will help you understand your

responsibilities with respect to the Utah Employment Security Act (hereafter

referred to as the Act) and to the Utah New Hire Registry reporting requirements.

The handbook will also help guide you in preparing required reports.

This handbook answers the questions that employers most frequently ask about Workforce

Services’ programs. If you have a question not covered in this handbook or need

additional information, contact us at:

Utah Department of Workforce Services

140 East 300 South 3rd Floor

P.O. Box 45288

Salt Lake City, Utah 84145-0288

Email: Employeraccounts@utah.gov

Phone: (801) 526-9235

or 1-800-222-2857

About Our Web Site

- Tax rates

- Quarterly reporting

- UI Tax publications, laws and rules

To register and access employer information, you must first create an account using

your e-mail address and user created password. You can then register as a new employer

or as an employer who has changed the legal status of your company. You can also

gain access to a specific employer account.

Once registered, employer advanced access requires the Utah Employer registration

Number and Personal Identification Number (PIN). This PIN is assigned when an employer

registers their business on our Web Site and is mailed to all new employers at their

tax address when the account is activated. With advanced access, you can:

- File tax reports

- View or amend tax reports

- View account profile

- Make a payment on an account

- View UI benefit costs

- Print IRS Form 940C

- File New Hire reports

- View previous new hire reports

- Update account contacts

- Request FEIN changes

- Close or reopen an account

- View electronic correspondence

- File an Appeal

Payroll providers or Accountants who are filing for five or more accounts are required to register for a Tax Preparer Administrative Account. The registration number will allow payroll providers or Accountants to upload and file for multiple accounts without having to provide a PIN number for each employer account. Only one Administrator Account is allowed per Tax Preparer business. After successful registration, you will need to log in to obtain access with your own email and password. The administrator will have the authority to remove any staff member’s Filing Access upon change in duties or termination. The Tax Preparer Administrator can grant Filing Access to staff who files quarterly reports for tax clients. To file quarterly reports, each staff member must log in using their own email address and password.

Basic access requires the Utah Employer Registration Number and Federal Employer Identification Number (FEIN). With the basic access, Tax Preparer Administrator and Filing Access users may:

- File tax reports

- View or amend tax reports

- View an account profile

- Make a payment on an account

- View UI benefit costs

- Print IRS Form 940C

- File New Hire reports

- View previous new hire reports

- File an Appeal

Advanced access requires the Utah Employer Registration Number and Personal Identification Number (PIN). With the advanced access, Tax Preparer Administrator and Filing Access users may:

- File tax reports

- View or amend tax reports

- Make a payment on an account

- View UI benefit costs

- Print IRS Form 940C

- File New Hire reports

- View previous new hire reports

- Update account addresses

- Update account contacts

- Request FEIN changes

- Close or Reopen account

- View electronic correspondence

- File an Appeal

What is the purpose of the Utah Employment Security Act?

The Utah Employment Security Act: (1) provides unemployment insurance payments to

unemployed workers who are eligible, (2) establishes a statewide system of local

employment centers offering employment services, and (3) gathers and dispenses related

workforce information.

Unemployment insurance benefits are paid to lighten the burden of unemployment for

the unemployed individual, maintain employment skills, maintain purchasing power

in the community, and allow laid off employees to remain in the area where they

will be available for re-employment.

Any unemployed person may apply for unemployment benefits and, if eligibility requirements

are met, may be paid at a rate determined by the claimant’s earnings from former

employers during the base period.

Base Period Wages Defined

Base period wages used in establishing a claim are the wages paid in the first four

of the last five completed calendar quarters prior to the filing of the claim. If

an individual lacks enough wage credit to qualify during this time, an alternate

base period of the last four completed quarters may be used.

Who pays for Unemployment Insurance?

The unemployment insurance program is operated on general insurance principles wherein

the employer pays the contributions into the Utah Unemployment Compensation Fund

(trust fund) to sustain the program. Governmental units, Indian Tribal units, and

nonprofit 501(c)(3) organizations have the option to: (1) pay contributions into

the fund based upon payroll wages in the same manner as other employers, or (2)

elect to become reimbursable employers who are liable for direct reimbursement to

the trust fund for benefits paid to individuals formerly in their employ in lieu

of paying quarterly contributions.

Who is subject to the Employment Security Act?

You are subject if you meet any one of the following:

- An individual or employing unit that employs one or more individuals

for some portion of a day during a calendar year.

- You acquired your business from an employer who was subject to this

Act.

- You are a nonprofit organization exempt from income tax as provided

by Section 501(c)(3) of the Internal Revenue Code and employ four or more individuals

for some portion of a day in each of 20 different weeks during a calendar year.

This Department requires a copy of the Internal Revenue Service letter of exemption,

501(c)(3), in order to be recognized as a nonprofit organization and to elect to

become a reimbursable employer.

- You pay cash wages of $1,000 or more in a calendar quarter to a

worker who performs domestic service (household employment).

- You employ agricultural workers and pay total wages of $20,000 or

more in a calendar quarter or have more than ten employees in 20 different weeks

during the calendar year. If you are an employer of a domestic service worker or

an agricultural worker or a 501(c)(3) entity and meet the criteria of a subject

employer, you are a subject employer for the calendar year regardless of the quarter

you met the criteria. You also become subject for the next calendar year. For example,

an agricultural employer who pays wages in excess of $20,000 in the third quarter

of 2012 becomes a subject employer effective January 1, 2012. This employer remains

subject for all of 2012 and 2013 regardless of the amount of wages paid in the other

quarters of 2012 and 2013.

- You are an officer of a corporation receiving remuneration for services

rendered.

- You are considered to be an employer subject to the Federal Unemployment

Tax Act (FUTA). FUTA coverage is based upon the employer’s annual calendar year

payroll. If an employer is subject to Utah law by virtue of being subject to FUTA,

all payroll is subject and reportable in all quarters regardless of the payroll

amounts You are an employer according to FUTA if you:

- Paid wages of $1,500 or more

in any calendar quarter

or

- Employed one or more workers

at any time in each of 20 calendar weeks.

What are wages?

Wages in the Act are the same as "currently defined by Title 26, Section 3306(b),

Internal Revenue Code of 1986." Additional information can be found in IRS Publication

15, Circular E, Employer Tax Guide and the Web site for The U.S. Tax Code Online

contains a detailed description of the definition of wages at:

http://www.fourmilab.ch/ustax/www/t26-C-23-3306.html

(case sensitive)

Wages include:

- Hourly wages, salaries, and commissions

- Meals, lodging and other payments in kind

- Tips and gratuities

- Remuneration for services of an employee with equipment

- Vacation pay and sick pay

- Separation or dismissal pay

- Bonuses and gifts

- Payments in stock

- Employee contributions to Deferred Compensation Plans, including 401(k)plans

Wages do not include:

- Any payment made to, or on behalf of, an employee under a cafeteria

plan. This exclusion is limited to any "qualified (non-taxable) benefit" provided

under a cafeteria plan as defined by Section 125 of the Internal Revenue Code. However,

employee contributions made under a 401(k) plan are wages subject to the Utah Employment

Security Act and must be reported.

- Meals and lodging provided on the employer’s premises and for the

employer’s convenience if a good business reason exists for providing them. Good

business reasons include the following:

- To have employees available

at all times or for emergencies.

- Employees have a short meal

period.

- Adequate eating and lodging

facilities are not otherwise available.

- Payments made by the employer to a group of individuals in his employ

into a fund to provide for:

- Medical or hospitalization

expense

- Death of an employee; provided

the employee does not have the right to any portion of money placed in the fund

at termination of the plan, or if the employee terminates employment with this employer.

- Reimbursement and advances for bona fide, ordinary and necessary

employment related expenses. DWS may require an accounting of the actual expenses

or may determine whether the expenses are reasonable and necessary.

- Employment related training allowances (Example: school tuition

and fees). However, payments for services performed as part of the training, such

as on-the-job training, are wages.

- Remuneration paid to directors of a corporation for director services

(i.e., attending board of directors meetings). Director services do not include

managerial services or other services that are part of the routine activities of

a corporation.

- A fee paid to an individual for the referral of a potential customer

(finder’s fee) provided that the transaction is in the nature of a single or infrequent

occurrence and does not involve a continuing relationship with the person paying

the fee.

- Supplemental Unemployment Benefits (SUB) if they meet the requirements

specified in Internal Revenue Service Revenue Ruling 56-249, 58-128 and 60-330.

Because of the complexity of the factors involved, employers should request a declaratory

ruling from DWS on their specific SUB plans.

What wages must be reported to Workforce Services?

All gross wages for each individual who worked for you during a calendar quarter

must be reported online each quarter. However, the Act establishes a maximum taxable wage

base that is recalculated annually. No contributions are assessed on any wages paid

to an employee that are in excess of this taxable wage base. This taxable wage base

is recalculated each year based on changes in the state average annual wage.

(See

Appendix F.)

When are wages reportable?

Wages must be reported for the calendar quarter in which they are paid, unless you

are a domestic employer who has elected annual reporting. The “Due Date” is the

last day of the month following the end of the calendar quarter. “Wages paid” are

those wages actually received by the worker or constructively paid without regard

to the ending date of the pay period, provided the payment is not delayed beyond

customary payment practices of the employer, contractual agreements between employer

and the workers, and state laws. Wages “constructively paid” are wages that should

have been paid. For example, the pay period for the business is March 15 through

March 30. The pay day is the following April 15th. If the wages are not paid to

the employee on April 15th, they should have been and hence have been constructively

paid. These wages need to be reported on the Employer’s Quarterly Contribution Report

for the second quarter and can be used by the employee if they file a claim for unemployment

benefits.

What is employment?

“Employment” means all work performed for you by persons (regardless of age) whom

you pay, whether their work is permanent or temporary, part-time or full-time, unless

the work is specifically exempted from coverage by the provisions of the Act. Employment

includes services performed by officers of a corporation including “S” corporations.

Wages of an individual employed to perform or assist in performing the work of an

employee are reportable by you for unemployment insurance purposes. An individual

is deemed to be engaged by the employee’s employer if the employer had actual or

constructive knowledge of the work performed by the individual. This is the case

even when the individual is hired or paid by the employee. An employer is deemed

to have constructive knowledge if they should have reasonably known or expected their

employee to engage another individual.

Interstate Employment

Wages are reportable to Utah if:

- The service is performed in this state. Service is considered

to be Utah employment if it is performed entirely within Utah. The service is also

considered to be Utah employment if performed both inside and outside of Utah, but

the service outside of Utah is incidental to the service in Utah.

- The service is not localized in any state. If the service

is not localized in any state but some of the service is performed by the employee

in Utah, the entire service is covered in Utah if one of the following conditions

apply:

- The employee’s “base of operations”

is in Utah (the “base of operations” is the place the employee physically checks

in on a regular basis),

- The employee has no base of

operations in Utah but is controlled and directed from basic authority which exists

in Utah and the employee does some work in Utah,

- The employee's residence is

in Utah and a or b above do not apply, or

- If a, b, or c do not apply,

the employer may elect the state where the employee is covered by making the election

under provisions for reciprocal coverage (Section 35A-4-106 of the Act).

Professional Employers' Organization and Temporary Service Employers

Professional Employers’ Organizations (also known as employee leasing companies)

and temporary service employers are employing units that contract with the clients

or customers to supply workers to perform services. DWS recognizes these types of

employing units as defined by the Professional Employer Organization Licensing Act,

Title 31A, Chapter 40 of the Utah Code.

Temporary service is defined as an arrangement whereby the organization hires it’s

own employees and assigns them to a client to support or supplement the client’s

own workforce in special work situations such as employee absences, temporary skill

shortages, seasonal workloads, and special assignments and projects. The assignment

of the temporary help must have a finite ending date and the temporary service employer

customarily reassigns the employees to other client organizations upon the completion

of each assignment.

A Professional Employer’s Organization is any properly and legally licensed employee

leasing company as defined by Section 31A-40-102 of the Utah Code. A Professional

Employer’s Organization enters into a co-employment agreement with the client which

is intended to be an ongoing relationship, rather than a temporary or project specific

relationship. In the absence of such compliance, DWS may choose to hold the “client

employer” as the employing unit. The Utah Administrative Code rules for “common paymaster,”

and “payrolling” do not apply to leasing companies who are in compliance

with the Professional Employer Organization Licensing Act.

Common paymaster and payrolling

A common paymaster is NOT allowed for unemployment contribution purposes.

A common paymaster situation exists when two or more related corporations concurrently

employ the same individual and one of the corporations compensates the individual

for the concurrent employment.

Payrolling is NOT allowed. Payrolling is defined as the practice of an employing

unit paying wages to the employees of another employer or reporting those wages

on its payroll tax reports.

Generally an employee is reportable by the employer:

- Who has the right to hire and fire the employee;

- Who has the responsibility to control and direct the employee;

- For whom the employee performs the service.

For unemployment contribution purposes, payrolling is NOT allowed. An exception

to this provision is noted in the rules pertaining to Professional Employer Organizations.

What employment is exempt from coverage?

Provided the services are also exempted under the Federal Unemployment Tax Act (FUTA)

employment shall not include:

- Domestic service in a private home, fraternity or sorority if the total cash remuneration

for personal services is less than $1,000 per quarter in each quarter of a calendar

year. Unless in the prior year, you paid wages of $1,000 or more in a calendar quarter.

- Agricultural labor as defined by the Act provided that the employer

pays less than $20,000 per quarter, in each quarter of a calendar year, for agricultural

labor and does not have 10 agricultural employees in each of 20 weeks during that

year. Unless in the prior year, you paid wages of $20,000 or more in a calendar

quarter or you had 10 or more agricultural employees in each of 20 weeks during

that year.

- Services performed by an individual owner (proprietor) and the owner's

spouse, parent(s) or minor child (under age 21).

- Services performed by a general partner. A worker who bears an exempt

relationship to all general partners (a minor child in a husband and wife partnership,

for example), would also be exempt.

- Services performed by a member of a limited liability company (LLC),

unless the LLC chooses to report for IRS purposes as a corporation thereby becoming

subject to FUTA.

- Licensed real estate agents, licensed insurance agents, and licensed

security brokers paid on a commission basis. Hourly wages or salaries paid to these

individuals are not exempt.

- Salespersons not working on the employer’s business premises who

are paid only by commission and are free from the employer’s control and direction.

- Private duty registered or practical nurses, if the nursing service

is performed in the patient’s home and if substantially all the compensation is

from health insurance proceeds. This exemption does not apply if any of the compensation

or fee is paid to a nursing service business.

- Pollsters or telephone survey conductors if the individual does not

perform the service on the employer’s premises, and the individual is paid for the

service solely on a piece-rate or commission basis.

- Casual labor but only if it is not in the course of the employing

unit’s trade or business.

Guidelines for Employments Status (Independent Contractors)

This contains guidelines for determining status as defined by the Utah Employment

Security Act, Section 35A-4-204(3).

Services performed by an individual for wages or under any contract of hire, written

or oral, express or implied, are considered to be employment subject to this section,

unless it is shown to the satisfaction of the division that:

- The individual is customarily engaged in an independently established

trade, occupation, profession, or business of the same nature as that involved in

the contract of hire for services; and

- The individual has been and will continue to be free from control

or direction over the means of performance of those services, both under the individual's

contract of hire and in fact.

The following factors are considered to determine if an individual is customarily

engaged in an independently established trade, occupation, profession or business:

- Separate Place of Business. The individual worker has his

own place of business separate from that of the employer.

- Tools and Equipment. The individual worker has a substantial

investment in the tools, equipment, or facilities customarily required to perform

the services. “Tools of the trade” such as those used by carpenters, mechanics,

and other tradespeople do not necessarily demonstrate independence.

- Other Clients. The individual worker performs services of

the same nature for other customers or clients and is not required to work full

time for the employer.

- Profit or Loss. The worker can realize a profit or risks

a loss from expenses and debts incurred through an independently established business

activity.

- Advertising. The worker advertises services in telephone

directories, newspapers, magazines, the internet, or by other methods clearly demonstrating

an effort to generate business.

- License. The individual has obtained any required and customary

business, trade or professional licenses.

- Business Records and Tax Forms. The worker files self-employment

and other business tax forms required by the Internal Revenue Service and other

tax agencies.

When an employer retains the right to control and direct the performance of a service,

or actually exercises control and direction over the worker who performs the service,

not only as to the result to be accomplished by the work but also as to the manner

and means by which that result is to be accomplished, the worker is an employee

of the employer for the purposes of the Act.

The following factors, if applicable, aid in determining whether an employer has

the right to exercise control and direction over the service of a worker.

- Instructions. A worker who is required to comply with another

person’s instructions about when, where and how they are to work is ordinarily an employee.

This factor is present if the employer for whom the service is performed has the

right to require compliance with instructions.

- Training. Training a worker by requiring an experienced person

to work with the individual, by corresponding with the individual, by requiring

the individual to attend meetings, or by using other methods, indicates that the

employer for whom the services are performed expects the services to be performed

in a particular method or manner.

- Pace or Sequence. A specific requirement that the service

must be provided at a pace or ordered sequence of duties imposed by the employer

indicates control and direction. However, mere coordinating and scheduling of the

services of more than one worker does not indicate control and direction.

- Work on Employer’s Premises. A requirement that the service

be performed on the employer’s premises indicates that the employer for whom the

service is performed has retained a right to supervise and oversee the manner in

which the service is performed, especially if the service could be performed elsewhere.

- Personal Service. A requirement that the service must be

performed personally and may not be assigned to others indicates the right to control

or direct the manner in which the work is performed.

- Continuing Relationship. A continuous service relationship

between the worker and the employer indicates that an employer-employee relationship

exists. A continuous relationship may exist where work is performed regularly or

at frequently recurring although irregular intervals. A continuous relationship

does not exist where the worker is contracted to complete specifically identified

projects, even though the service relationship may extend over a significant period

of time.

- Set Hours of Work. The establishment of set hours or a specific

number of hours of work by the employer indicates control.

- Method of Payment. Payment by the hour, week or month points

to an employer-employee relationship, provided that this method of payment is not

just a convenient way of paying progress billings as a part of a fixed price agreed

upon as the cost of a job. Control may also exist when the employer determines the

method of payment.

These factors are intended only as guides for determining whether an individual

is an employee or independent contractor. The degree of importance of each factor

varies depending on the occupation and the factual context in which the services

are performed.

Workers classified as “independent contractors” either by themselves, by the principal

for whom they work, or by contract are not excluded from being considered in employment

simply because of that classification. The Act does not contain the term “independent

contractor” and an exclusion for such does not exist. In order for the services

performed by workers to be excluded from coverage under the Act, they must satisfy

both tests mentioned above.

If you have classified or contemplate classifying any of your workers as “self-employed”

or “independent contractors,” please notify DWS in order that a proper determination

of status can be made. By doing this, you may avoid additional unexpected liabilities,

interest and penalties.

What must an employer pay?

An employer who is subject to the Act is required to pay contributions to the Utah

Unemployment Compensation Fund (trust fund) on a quarterly basis (annual election

for domestic/household employers). These contributions (unemployment taxes) are

determined by multiplying the total subject wages for all employees each quarter

by the employer’s assigned contribution rate.

The entire amount of contribution (tax) must be paid by the employer. The Act provides

penalties for employers who deduct any part of the contribution from the earnings

of the employee.

Payment should be made by Electronic Funds Transfer (EFT) at https://jobs.utah.gov/ui/Employer/Login.aspx.

How is the contribution rate calculated?

New Utah employers are assigned a rate based upon the average rates of all employers

in their respective industries. An “earned” rate based upon payroll and benefit

experience is assigned January 1 of the year following their first full fiscal

year (July 1 through June 30) of reporting.

The unemployment insurance contribution “earned” rate for rated or qualified Utah

employers is determined from the experience each employer has accumulated over previous

years of coverage in the Unemployment Insurance Program. Utah’s law calls for a

“benefit ratio” to be determined for each qualifying employer. This means that unemployment

insurance benefits paid to your former employees will be used as the primary factor

in calculating your contribution rate. These payments are known as benefit costs.

Benefit costs for your former employees will be charged to you in the same proportion

as the wages paid by you in the claimant’s base period year to the total wages of

all employers of that individual worker in his base period. For example, if 50%

of your former employee’s earnings during his base period year have been paid by

you, then 50% of the unemployment benefits paid to this former employee would be

charged to your account.

When an individual files a claim for unemployment benefits, all base period employers

are notified that a claim has been filed on Form 606, “Employer Notice of Claim

Filed” and informed of the potential benefit costs that may be charged against them.

Any protest of a claimant’s eligibility for benefits or request for relief of benefit

cost charges based on the reason for separation of the employee must be made at

this time. Relief will not be granted if you do not protest when first notified

by Form 606.

As benefits are actually paid, you will receive a quarterly, Form 66, “Statement

of Employment Benefit Costs.” (This information can also be found on our web site

under Display Benefit Costs.) Your benefit costs for a minimum of one year and up

to the last four fiscal years (July 1st through June 30th), will be used in the

computation of your contribution rate for the following calendar year..

If the benefit costs charged to your account are inconsistent with a prior decision

or action that was or should have been taken by DWS, you may request that corrections

be made. The request must be filed in writing within 30 days of the date

of the quarterly statement.

Your overall contribution (tax) rate will be determined for each year by the following

four factors:

- Benefit Ratio (basic tax rate): This rate is determined by

dividing total benefits paid to your former employees by the total taxable wages

reported to DWS by you during the same period of time. The last four completed fiscal

years will be used in determining the contribution (tax) rate. New employers are

assigned a basic contribution rate equivalent to the two-year average benefit cost

ratio of their major industry, but not less than 1%.

Benefit costs charged to your account can be viewed on our web site under Display

Benefit Costs.

- Reserve Factor: This is an adjustment to the basic contribution

rate (an increase or decrease) which is necessary to maintain an adequate reserve

in the Utah Unemployment Compensation Fund.

- Social Tax Rate: This rate is determined from the benefit

costs which cannot be allocated to any particular employer. This rate is added to

the contribution rate for all employers. Examples of benefit costs which are considered

to be social costs include:

- Benefit costs of employers

who have gone out of business without having successors.

- The state’s share (50%) of

benefit costs which result from the payment of federal extended benefits paid during

periods of high unemployment.

- An employer’s benefit costs

which exceed the maximum contribution (tax) rate plus the social costs.

- Benefit costs from which employers

have been granted relief.

- Uncollectible benefit overpayments.

- Rate Surcharge for Delinquent Payments: The Act provides

for a surcharge of 1% of taxable wages in addition to the overall contribution rate

for employers who have not paid all contributions for the fiscal year (July 1st

through June 30th) prior to the January 1st computation date.

The surcharge will be removed in the quarter in which all delinquent contributions

for the prior fiscal year (July 1st through June 30th) have been paid.

The overall contribution rate is calculated as follows:

Benefit Costs

Total Taxable Wages

|

x

|

Reserve

Factor

|

+

|

Social

Tax

|

=

|

Overall

Contribution

Rate

|

The employer contribution rates are calculated early in December for the following

calendar year after all benefit and social cost data have been finalized. You will

be notified in writing of your assigned rate and the factors used in determining

your rate for the upcoming calendar year. An annual domestic employer’s rate may

be modified at a later date.

What is SUTA dumping?

The Legal References Behind SUTA Dumping

Congress passed the SUTA Protection Act of 2003 to ensure that state unemployment

insurance (SUI) rates are fair for all employers. The State Unemployment Tax Act

contains provisions (refer to the Act 35A-4-304 or the Rule 994-304) that govern

the transfer of employment experience and the assignment of rates.

Background

The State Unemployment Tax Act (SUTA) contains provisions banning two common forms

of SUTA dumping which are best described as tax manipulation schemes. In the first,

a new company buys an existing company to obtain its lower rate. In the second,

a new company is created to which employees are transferred in order to dump an

existing employer’s past history and higher rate. Without a new DWS rate calculation,

either version may represent SUTA dumping when common ownership, management, or

control of business practices exists.

Controlling SUTA dumping protects all employers who otherwise would need to pay

more in unemployment insurance to maintain the solvency of the trust fund. Employers

who engage in this practice are not allowed to abandon benefit costs or its associated

state unemployment insurance (SUI) rate. Instead, the businesses for such an employer

would share the higher, combined rate. SUTA dumping also may expose the employer

to both civil and criminal penalties and to a higher, punitive rate.

Special Provisions Regarding Transfers Between Entities With Common Ownership, Management

or Control

If an employer transfers its trade or business (including its workforce) or a portion

of its trade or business to another employer and, at the time of the transfer, there

is common ownership, management or control of the employers, then the unemployment

experience attributable to each employer shall be combined and both entities will

have the same UI contribution rate for up to four years. The Act provides meaningful

civil and criminal penalties for all individuals, including tax advisors, who knowingly

violate or attempt to violate this provision of the Act.

Complying with the Law

To ensure compliance with the law, visit the DWS website to obtain a Form 1 (See

Appendix A

for an example). As an alternative, call us and we will fax the form. This form

asks for percentages of the business being transferred and to whom. After receiving

this form, DWS will calculate the SUI rate. This also will ensure that the employer’s

account number is retained rather than creating an unnecessary, new one. If you

have questions or concerns about moving payroll, please contact this department

at 801-526-9235 or 800-222-2857 and select option 3 for either number.

What does it mean to be a "Successor" employer?

“Successor” is the employing unit which acquires substantially all of a business

and “predecessor” is the employing unit which last operated the business. For the

purposes of rate computation, all of the predecessor’s payroll and benefit costs

will be transferred to the successor if the successor has acquired the business

or all or substantially all of the assets of the predecessor business and the predecessor

has ceased to operate subsequent to the acquisition.

To “acquire” the assets means to now possess, control, or have the right to use

the assets by any legal means such as by purchase, gift, lease, or sub-lease, repossession,

change in the form of ownership, inheritance, or foreclosure. It is not necessary

to purchase the assets in order to have acquired the right to their use, nor is

it necessary for the predecessor to have actually owned the assets for the successor

to have acquired them.

Additionally, as a successor employer, you assume the liability for any unpaid contributions

owed by your predecessor. It is your responsibility to withhold a sufficient amount

of the purchase money to cover the amount of any contribution, interest, and penalty

that may be due to DWS from your predecessor prior to the transfer.

We recommend that you obtain access to your predecessor’s payroll records in order

to furnish DWS with wage and separation information on individuals employed by your

predecessor prior to the transfer. This allows you the opportunity to request relief

of charges, based on the separation, and reduce the potential liability against

your account.

Information an Employer Must Provide to Employees?

As an employer subject to the Act, you are required to post the “Unemployment Insurance

Notice to Workers” poster in a conspicuous place in each work place or establishment.

The purpose of this poster is to provide workers with initial information regarding

their rights to unemployment benefits. Please telephone (801) 526-9235 or toll free

1-800-222-2857 and select option 9 to obtain these or other DWS forms.

What records must an employer keep?

In order to complete the required reports and verify this information at a later

date if necessary, your records must contain the following information:

- The name and social security number of each employee.

- The date each employee was hired.

- The place of employment.

- The date and reason each employee was separated from employment.

- The beginning and ending date of each pay period and the date wages

were paid.

- The total amount of wages paid (in each pay period) showing wages

separately from other payments such as tips and bonuses.

- Daily time cards or time records kept in the regular course of business.

- Special payments such as bonuses, commissions, gifts, severance

pay or accrued leave pay.

- The cash value of living quarters, meals, or anything else paid

to an employee as compensation for work done.

In general, you are required to keep these records for four (4) calendar years (see

Utah Code 35A-4-310).

Audit of Records

DWS has the responsibility and authority to audit your records periodically. A DWS

representative may contact you to examine your records. In most cases, an appointment

will be arranged at a mutually satisfactory time.

What reports/forms must an employer submit?

Most of our reports/forms may be accessed on our web site at https://jobs.utah.gov/ui/Employer under public tax forms..

Reports most frequently required are:

- Status Report, Form 1 (See

Appendix A). This report allows you to register your business and gives

the information necessary to determine whether you are subject to the Act. All new

or acquired businesses must submit this form. A new Status Report will also be required

for an existing account if the entity or ownership of the business has changed.

Necessary changes can then be determined from the information acquired. This form

may be downloaded from our web site or is available on request.

You may also register your business online at https://jobs.utah.gov/ui/Employer/EmployerRegistration/. You will receive

an account number, PIN number, and rate at the end of your registration. Once your

account has been finalized by a status examiner, you will be able to access any

of our confidential services.

Account changes may be completed online by accessing our confidential services.

If you prefer, you may notify us of changes to your account such as the type of

business activity your firm engages in and changes of address or site location of

your business in writing. However, a change in entity or ownership will require

you to register the new business or entity. Our address is:

Department of Workforce Services

Attn: Employer Accounts • PO Box 45288

Salt Lake City, UT 84145-0288

- Employer's Quarterly Wage List and Contribution Report

Once subject to the Employment Security Act, an employer must file the Employer's

Quarterly Wage List and Contribution Report online each calendar quarter. Our website contains

the combined report and payment option. Each employer must send quarterly wage contribution

reports even if wages are not paid during the quarter until DWS closes the account

or determines that the employer is exempt from reporting requirements.

Online filing is the required reporting option. Employers must submit these reports

with the contributions due within 30 days following the end of the quarter.

If you are a domestic employer, you will be given the option to file quarterly or

annually. If you choose to file annually, your report is due January 31st of the

following year in which you had wages. The report is broken down by quarter.

Online Filing for Quarterly Contributions and Wages

Online filing is a fast, secure method for you to report wages and will automatically

and accurately calculate your tax liability. Data can be manually entered or you

can upload a file.

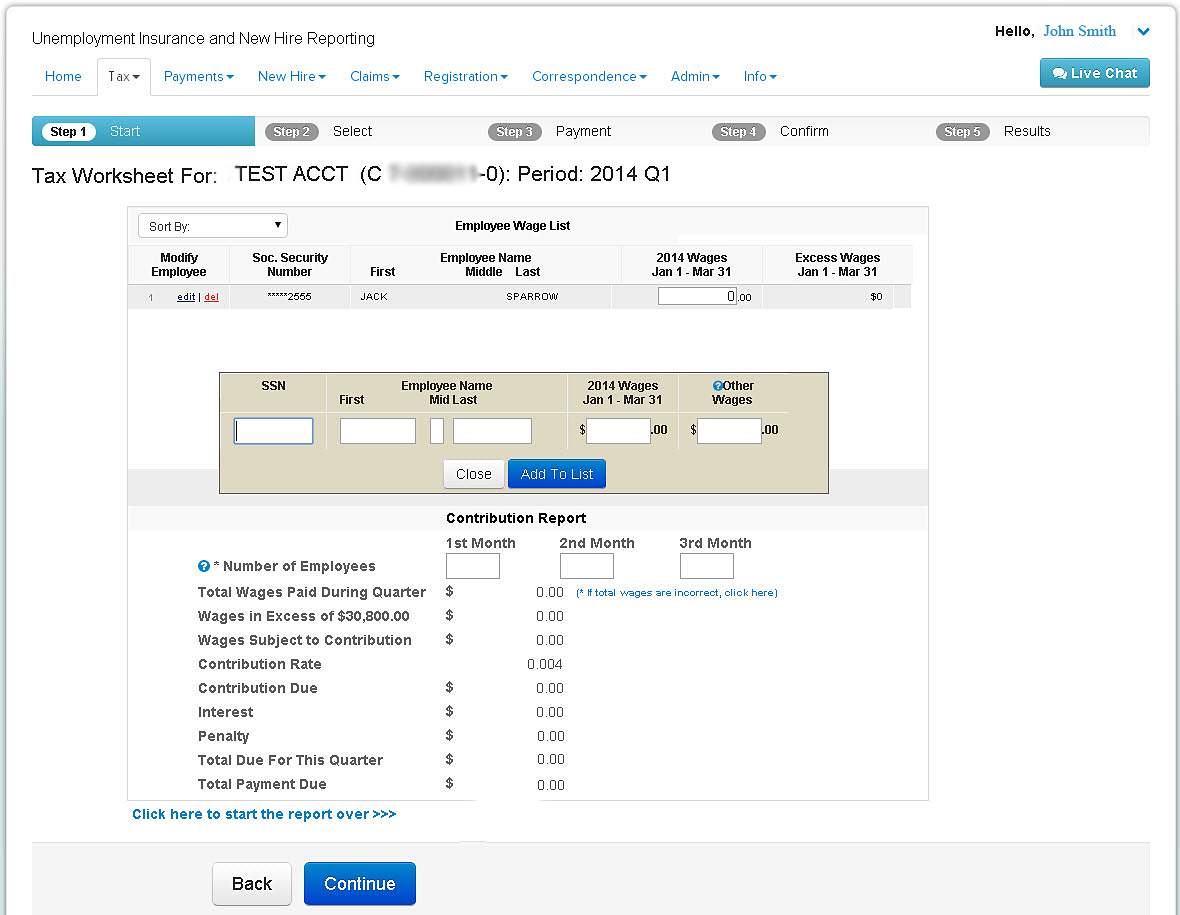

For screenshots on how to log into your account, add an existing business, and access

the online filing option,

click here.

Manual Entry

The first quarter you file online, you will need to enter the individual's First

Name, Last Name, and Social Security Number. For all subsequent quarters, this information

will automatically populate with details from the previous quarter. To delete employees

that are no longer employed, use the button on the left-hand side and to add new

employees use the button in the center of the page. The screen will look like this:

Upload A File

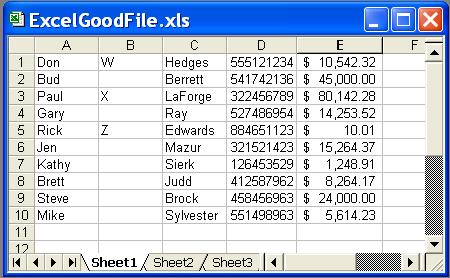

Microsoft Excel (when submitting reports for one employer at a time)

Each file must have five columns: First Name, Last Name, Social Security Number,

and Quarterly Wage Total. An example of a valid Excel file is below:

* Please note: The above example shows a middle initial. The middle initial field

is not required.

After the file is uploaded, you will be taken to the Manual Entry screen listed

above to confirm the information.

Excel File Upload Tips

If you encounter problems uploading an excel file try saving it as an Excel 97-2003

workbook. To do this:

- On the File tab click on the 'Save As' button.

- A new window will open with two drop down boxes labeled as 'File name:' and 'Save

as type:'

- In the 'Save as type:' box, click on the drop down and choose the 'Excel 97-2003

workbook' option.

- Then click on the 'Save' button in the lower right hand corner.

- You can now follow the upload procedures as outlined.

Try deleting any additional worksheets. To do this:

- Open your file and locate the worksheet tabs on the lower left hand side.

- Right click with your mouse on the sheets that do not contain any data.

- You will see a small window open and from the list of options choose 'delete'.

- This will remove the additional worksheet and you can now follow the upload procedures

as outlined.

If you have a problem uploading a file with Social Security numbers that begin with

a '0', you can change the format of the column to correct the issue. To do this:

- Right click on the header for the column and select 'format cells'.

- On the number tab, select 'Text' as the number format and click 'ok'.

- This should resolve the problem.

This information must be correct in order that a proper determination of the claimant’s

eligibility can be made or that relief of charges may be granted to you, the employer.

Employers can receive Unemployment Insurance correspondence electronically from

a secure web message center. The advantages of this method include the following:

To ensure compliance with the Utah Employment Security Act and avoid the extra expense

connected with obtaining and processing delinquent reports, the Act provides for

the following penalties that attach to late reports and payments.

You may obtain an extension of up to 30 days for filing contribution reports and

making payments by requesting the extension in writing before the report or payment

is due and showing good cause for the delay. Penalties will not be assessed if the

report or payment is submitted on or before the extended due date. However, interest

is assessed on unpaid contributions from the original due date.

The due date for filing the Federal Unemployment Tax return (IRS Form 940 and Form

940 EZ) must be considered in any extension for late filing of the fourth quarter

report. The Internal Revenue Service will not allow full credit against federal

unemployment insurance taxes for contributions (taxes) paid to the State for the

fourth quarter if the contributions are paid after January 31st.

When a claim is filed, the effective date is the Sunday of the week the claim is

filed and is in effect for 52 weeks. The amount payable on the claim is determined

by the wages reported in the base period, which is the first four of the last five

completed calendar quarters prior to the filing date.

To be monetarily eligible for benefits, a worker must have earned wages in two or

more calendar quarters of the base period. The total wages in the base period must

be at least 1.5 times the wages earned in the highest quarter of the base period.

There is also a minimum amount of wages required during the base period. For 2010,

the minimum total amount is $3,100.

A claimant is entitled to a weekly benefit amount (WBA) equal to 1/26th of the highest

quarter wages in the base period. A maximum weekly benefit amount is established

each year. For 2011, the amount is $452 a week. Claimants receive a weekly benefit

amount that is approximately one-half of their average weekly earnings in their

highest quarter up to the maximum weekly benefit amount.

A claimant can receive regular benefits for 10 to 26 weeks, depending on the stability

of their prior unemployment. During periods of exceptionally high levels of state

or national unemployment, additional weeks of benefits may be provided.

Appeals from a decision made by an Administrative Law Judge may be submitted to

the Board of Review of the Utah Department of Workforce Services. Further appeals

are made to the Utah Court of Appeals.

If you or the claimant appeal a Department decision, you will be notified of the

time and place of the fact finding hearing conducted by an Administrative Law Judge.

This represents your last opportunity to provide information. Therefore, be sure

that this information is complete.

The hearing will be tape recorded as required by law. All testimony will be taken

under oath. The hearing allows both parties to present all available testimony and

evidence regarding this case. If either party chooses to appeal the decision, there

will not be another hearing. The testimony and evidence presented at the hearing

will become the case record available for review in the event of a further appeal.

For this reason, each party should present all testimony and evidence at the hearing.

The parties will be asked if they understand the importance of presenting all testimony

and evidence.

For more information on the appeals process, please visit the Division of Adjudication

web site at http://jobs.utah.gov/appeals/.

Utah’s “benefit ratio” system provides a unique opportunity for you to manage your

unemployment tax costs. As a new employer, your rate is based on an industry classification.

With more experience as an employer, your basic tax rate is now determined by the

unemployment benefits paid to your former employees. It is to your advantage to

monitor these charges to ensure they are correct and to manage your personnel practices

to reduce layoffs wherever possible.

To assist you in managing these costs, please consider the following:

New Hire Legislation appears in Section 35A-7-101. This chapter is known as the

“Centralized New Hire Registry Act.” Our state law’s minimum reporting requirements

are based on the federal law. The Utah Department of Workforce Services has been

given the responsibility for administering the State New Hire Registry program.

States will match New Hire reports against their child support records to locate

parents, establish a child support order, or enforce an existing child support order.

The State will transmit the New Hire reports to the National Directory of New Hires

(NDNH), which allows the Office of Child Support Enforcement to assist States in

locating parents on a national level.

States’ Unemployment Insurance and Workers’ Compensation Programs may also have

access to their State New Hire information to detect and prevent erroneous benefit

payments. In addition, the State can conduct matches between the New Hire database

and other State programs to prevent unlawful or erroneous receipt of public assistance

payments.

This initiative has resulted in significant increases in child support collections,

reductions in Temporary Assistance to Needy Families (TANF) payments, and millions

of dollars saved in Medicaid, Supplemental Nutrition Assistance Program (SNAP),

formerly known as Food Stamps, Unemployment Insurance Benefits, and Workers’ Compensation

Claims.

In order to simplify the new-hire reporting process, employers have a number of

options for reporting employee information. Employers may submit reports by using:

Regardless of the format used, employers should make certain that all of the required

information is included. The employer street address should be the address where

child support orders should be sent.

An employer who fails to timely report the hiring or rehiring of an employee as

required by law is subject to a civil penalty of:

Significantly, DWS is the only source providing county-level economic information

such as wages, the unemployment rate, and the largest employers in the county.

All of our products and publications are available on our web site. Some products

are available ONLY on the web. Some of our major products/publications are:

As businesses restructure to improve productivity and reduce costs, workers and

businesses often face the uncertainty of change. Fortunately, the state offers tools

to help workers and businesses adapt to those changes. Through DWS’ Rapid Response

Team, (801) 526-4312, state specialists provide free assistance to companies and

their affected workers facing corporate restructuring.

This material was prepared to provide you with general information about the unemployment

insurance program and a brief description of other DWS services. Our goal is to

provide quality employment related services sensitive to the needs of workers, employers

and the community.

If you have questions or need assistance, please call one of the following numbers:

(if you are calling long distance, call toll free at 1-800-222-2857).