By Michael Jeanfreau, Senior Economist

Knowing the profile of an area’s economic structure is the first step toward managing and fostering economic and workforce development. Location quotients (LQs) are a statistical tool used to probe the relative concentrations of specific industries, occupations, or types of employment in geographic areas compared to the national average. LQs provide insights into any area’s economic specialization and help identify unique strengths and weaknesses that underlie its economic landscape.

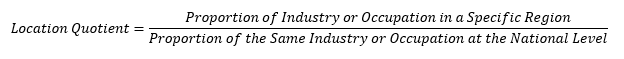

The formula for calculating a location quotient is straightforward:

Here's how to interpret the results:

If the LQ is 1, it means that the region has the same employment proportion of the industry or occupation as the national average. When a region has an LQ of 1, it is considered economically diverse.

If the LQ is greater than 1, it indicates that the industry or occupation has a higher employment concentration in the specific region compared to the national average. This suggests a specialization in that sector.

If the LQ is less than 1, it suggests that the industry or occupation has a lower employment representation in the region compared to the national average. This does not point toward specialization.

So, why do location quotients matter?

In essence, location quotients serve as tools for policymakers, economists, and businesses to understand the economic dynamics of a region, identify areas of specialization, and make informed decisions related to investments, workforce development, and policy planning. They offer a nuanced perspective on regional economic structures and contribute to strategic development and growth initiatives.

1. Economic Identity:

LQs reveal what makes a region tick economically. They unveil the sectors where a region excels, forming the bedrock of its economic identity. For instance, in the context of Utah, LQs can show the dominance of tech in Silicon Slopes, the manufacturing prowess in the north, or the tourism stronghold in the south.

2. Strategic Decision-Making:

Policymakers, economic developers, and businesses leverage LQs for strategic decision-making. Understanding the economic specialties of a region allows for targeted investments, informed workforce development and/or education initiatives, and the crafting of policies that align with the region's foundation.

3. Workforce Planning:

LQs are valuable for workforce development and planning. They provide insights into the demand for specific skills and occupations, enabling supportive workforce development. This knowledge ensures that educational and training programs align with the needs of local industries, fostering a specialized and sufficient workforce.

4. Regional Competitiveness:

LQs contribute to the assessment of regional competitiveness. Identifying and nurturing specialization strengths can enhance a region's competitive advantage, attracting businesses, talent, and investments that align with its economic focus.

Location quotients serve as a diagnostic tool, unveiling the economic health of a region and prescribing strategies for growth. They are not only measures of success or failure; they are keys that unlock the door to regional economic understanding and prosperity. They prompt critical questions: What drives this specialization? How can it be leveraged for growth? What is needed to sustain it? What areas might need attention to achieve a more balanced economic portfolio?

Evaluating LQs by industries versus occupations is largely dependent upon the desire of the focus. What industries underpin a local region can be a slightly different look than what occupations underpin a region. For example, in the Seattle, Washington area, manufacturing helps to underpin that economy with aircraft manufacturing. In Logan, Utah, manufacturing also underpins the economy, but it is instead food manufacturing. A different mix of occupations is needed to support Seattle’s manufacturing needs than the mix needed to support Logan’s manufacturing structure. Since occupations bring the dialogue down to a worker level, the remainder of this article will focus on occupational LQs.

Standard Occupational Classification (SOC) Codes: Understanding Jobs in Simple Terms

To evaluate Utah’s occupational LQ view, Utah’s economy can be divided into occupational codes using the nationally accepted Standard Occupational Classification (SOC) System. SOC codes are labels that help organize and make sense of the workforce. Created by a collaboration of federal agencies on the SOC Policy Committee (SOCPC), SOC codes are a system that sorts jobs into categories based on the tasks people do, the skills they need, and what their job involves.

SOC codes are numeric. At the highest level, SOC codes use two-digit number classifications to group major job categories, providing a big-picture view of different categories of work. SOC classification becomes increasingly granular with the assignment of additional digits, capping at six digits. This allows jobs to be parsed into details about specific roles within those larger categories For example, occupations that start with 35 are in the food preparation and serving related classification. As digits are added, the job title and description become more specific. So, within food preparation and serving related jobs that all fall within 35-0000, there are specific detailed occupations such as 35-3023 (fast food workers) or 35-9031 (hosts and hostesses).

A Look at the Beehive State

Utah's employment landscape reflects a relatively diverse economy achieved through a counterbalance of lesser and greater concentrations. Ideally, economy watchers would desire all occupational categories to measure “1”. This means that the entire occupational spectrum is as economically diverse and balanced as possible. Not too many eggs in any one basket; nor too few. Yet, reality rarely achieves such. Instead, overall balance can be simulated by having over and underrepresented categories countering each other, with that countering centering around a cumulative assemblage of “1” as much as possible. For Utah, its assemblage measures around 0.96. That is a commendable occupational balance compared to many other states.

When LQs have deviated either above 1.2 or below 0.8, they reveal the over- or under-balanced occupational groups. These can be looked upon as either strengths or weaknesses, depending on the landscape. When one has a high concentration of high-paying engineering jobs in an economy, this is viewed as a strength. What if an area has a high concentration of low-paying telemarketing jobs? Is that considered a strength? Some may say no. But what if such serves the local area well? What if there is a high concentration of college students who thrive in this industry due to abundant part-time and flexible work opportunities? Is it now a strength, or do the lower wages make it a weakness? Labeling LQs as strengths or weaknesses can be subjective and relative to the overall situation. However, identifying high and low concentration LQs does expose to the economy watcher where such non-balances exist, and then an evaluation upon what overall significance such may have on the greater economy.

Utah has a high concentration of construction and extraction jobs. With 101,940 total employment and a high location quotient of 1.52, Utah has a significant presence in construction and extraction occupations, suggesting a robust construction industry.

Computer and mathematical jobs also appear as significantly above the national average, with an LQ of 1.22 and employment of 67,240 workers. The urban, business-oriented metro of Salt Lake and tech centers of Silicon Slopes are where these jobs are concentrated, with other regions in the state underrepresented within the occupational field.

On the other end of LQs are occupational groups that are underrepresented in Utah. Healthcare practitioners and technical occupations along with healthcare support are far less prevalent than the national average. With an LQ of 0.77 and 0.66 respectively, these occupations are three-quarters the size that would be expected if Utah’s economy was proportionally the same as the nation’s, despite representing over 127,000 workers. What makes Utah different is the state’s younger average age. In 2022, the average median age in the United States was 39. In Utah, the average median age is only 32.1. The state's relatively young population lowers the demand for healthcare practitioners and technicians. Younger people tend to require fewer healthcare services. Here is an example of that subjective view of LQs. The healthcare occupation concentration is below the national average, but that can be a good thing in this case.

Protective services encompassing law enforcement, firefighting, and emergency services, also exhibit a unique profile in Utah. The sector's low location quotient of 0.65 is influenced by the state's demographic and largely rural landscape. Unlike some coastal states with sprawling urban centers, Utah's major cities are comparatively smaller, and the state as a whole maintains a reputation for safety. As a result, the demand for protective services is proportionally lower, contributing to the lower location quotient. This underlines the contrast between Utah and states with larger urban concentrations that often require a more extensive protective services infrastructure.

In summary, Utah's economic landscape, as revealed by occupational location quotients, showcases not only the strengths and concentrations in sectors such as construction and technology, but also the unique characteristics that contribute to the underrepresentation of certain occupations such as healthcare and protective services.

Looking at Regional Uniqueness

The same methods applied to analyze the state can be used in smaller regions to gain similar insights. In addition to looking in finer geographic detail, the hierarchical nature of SOC codes also allows a closer examination of jobs within each occupational family. Metropolitan Statistical Areas (MSAs) are used by BLS to group areas as large functioning economic bodies. In Utah, five MSAs encompass the majority of the state’s economic activity, each with unique traits and subsequent LQs.

Map of Metropolitan Statistical Areas in Utah, 2022

Since LQs are calculated using proportions, dividing up the state’s labor force into MSA segments can break down the state’s overall LQ profile. When comparing the relatively small workforce of one region compared to the massive labor force of the nation, specialization and uniqueness increase. Industries tend to become more concentrated as geographic areas get smaller and overall economic opportunities diminish. For example, imagine analyzing only one street. It makes a significant difference if that street is a shopping mall, business center, or rural road. In each case, limited occupations will be present, leading to massive over-representation of specific jobs and a complete absence of other sectors. However, it still accurately tells the story of that area. With this in mind, a highlight upon each Utah MSA tells a distinct story not only of that area’s economy, but also of its residents, geography, culture, and history.

Salt Lake City

Salt Lake City, which as an MSA includes Salt Lake and Tooele counties, comprises close to half of the state’s workforce, totaling over 780,000 employed persons. This is the only MSA that contains a high level of life, physical, and social sciences occupations, and is also the only MSA to have legal occupations at an LQ above 1. The county’s proximity with the Provo-Orem MSAs Silicon Slopes designation cultivates a high prevalence of computer and mathematical jobs as well as management occupations. Meanwhile, protective services, while only an LQ of 0.65, is the highest concentration of that occupational family in the state. Despite being a major urban metropolitan city, Salt Lake City is well below the national average in Protective Service occupations.

Highlights of Detailed Occupational Codes

The Salt Lake City MSA is Utah’s most occupationally diverse MSA and subsequently has the least deviation from the national average at a high-level view. However, at a more detailed scale, interesting specializations stand out, like the high employment of models (LQ of 8.32) or wood patternmakers (LQ of 17.13). Salt Lake City boasts the highest location quotient in the nation for both occupations.

Provo-Orem

Identified with Silicon Slopes, the Provo-Orem MSA hosts a high concentration of Utah’s tech sector. Encompassing Juab and Utah counties, the region boasts the highest computer and mathematical LQ in the state at 1.72. Management also has a significant presence in the area, with corporate centers present. The occupations in low concentration are a result of demographics, such as the low healthcare and protective services proportions, or geography, with the nearby Salt Lake City MSA diverting many life, physical, and social science, and legal occupations.

Highlights of Detailed Occupations in Provo-Orem

In the major tech industries, marketing managers and web developers lead. Along with the tech and information sectors in the Provo-Orem area, Brigham Young University provides a high concentration of postsecondary teachers, with over 720 employed, as well as a thriving sports scene, with sports officials at an LQ of 11.24. Credit counselors also appear in high concentration, with an LQ of 6.34. While stoneworker helpers appear in high concentration throughout Utah, at 8.87, Provo-Orem boasts the highest stoneworker specialization in the nation.

Ogden-Clearfield

Consisting of Box Elder, Davis, Morgan, and Weber Counties, the Ogden-Clearfield MSA is tied together by a bedrock of production and engineering, largely around durable goods from major employers and the presence of Hill Air Force Base. Along with the rest of the state, construction occupations are comparatively high-proportioned compared to the rest of the nation. Conversely, farming, fishing, and forestry occupations have a limited presence in the area.

Highlights of Detailed Occupations in Ogden-Clearfield

The dominance of manufacturing production significantly fostered by the presence of Hill Air Force Base generates a high concentration of aerospace engineers and molders, shapers, and casters. Further parsing reveals another relationship to the Federal government: the high concentration of information and record clerks as a result of the Internal Revenue Service facility in Ogden.

Logan, UT-ID (Cache County, Utah & Franklin County, Idaho)

The Logan MSA includes Cache County, Utah and Franklin County, Idaho, and is the only Utah MSA to cross state lines. The area is a powerhouse for production occupations, spread between consumable/food and durable good production. The presence of Utah State University (USU) and Bridgerland Technical College is reflected in the county’s educational and library occupations. The area’s rural nature reflects a limited need for protective services, and USU’s large presence keeps healthcare occupations low by fostering a low average population age.

Highlights of Detailed Occupations in Logan

The Logan MSA boasts a healthy mix of production and education, which hosts a variety of skill and educational levels. The high concentration of career and technical education teachers is unique on its own, and furthers the development of a skilled labor force in the region. Butchers and meat cutters along with food batchmakers speak to the area’s food production, with multiple large food manufacturing companies in the Cache Valley. Electrical engineers and carpenters are common in the durable goods industry.

St. George

St. George is known for being the “retirement center” of Utah and is flourishing as the large Baby Boomer generation ages into retirement. Building and ground cleaning and maintenance specialization speaks to an economy concentrated upon its local clientele, as does personal care and service. Interestingly, this is the only MSA to have close to average healthcare occupational presence. Despite having a local college, the median age in St. George is 39.5, closer to the national average of 39 than to Utah’s 32.1. In retirement-oriented areas like St. George, occupations like production and business and financial operations are found in low concentration.

Highlights of Detailed Occupations in St. George

St. George boasts, with its desert environment and quickly growing population, the highest concentration of plasterers and stucco workers in the nation, with an LQ of 14.79. The same is true for tile and stone setters, with an LQ of 13.78. Jewelers and furniture finishers cater to wealthier retirees, while the geography allows for some surface mining in the region.

The Takeaway

Exploration of Utah's economic landscape through the lens of location quotients (LQs) provides valuable insights into economic structuring. One must first understand an economy before commenting or maneuvering upon it. Location quotients provide the economic “what” portion of the who, what, where, when, why, and how inquiry. From here, the proper additional questions will arise. And from those, the areas of action, reaction, and support will develop. Understanding Utah’s economic structure and leveraging these insights will be key to sustaining growth, attracting talent, and ensuring the resilience of Utah's diverse and dynamic economic identity.