-

- Overview

-

- Emergency Food Assistance

- Homeowner Assistance Fund

- HEAT

- HEAT Forms

- Local HEAT Offices

- Home Electric

- Home Gas

- Shut-Off Protection

- Energy and Water Tips

- Resources

- Earned Income Tax Credit

- Overview

-

- Navajo Fund

- Subdivision Ordinance Consultant Pool

- Uintah Basin Fund

- Overview

-

- Section 8 Landlord Incentive

Frequently Asked Questions

- What are Private Activity Bonds (PAB)?

- Issued for the benefit of private individuals or entities.

- Issued on a tax-exempt basis if they are "qualified." This means they fit under any of the seven categories of qualified bonds outlined by the Internal Revenue Code (“IRC”). (Utah uses four of the categories.)

- The owner (buyer) of a tax-exempt bond does not pay federal income tax on the interest received on such bonds; consequently, tax-exempt bonds bear lower interest rates than bank loans or taxable bonds. This lower borrowing cost is passed on directly to the borrowing entity.

- What are the Benefits of Tax-Exempt Bonds?

- Interest rates on tax-exempt bonds are considerably lower than rates on comparable taxable bonds.

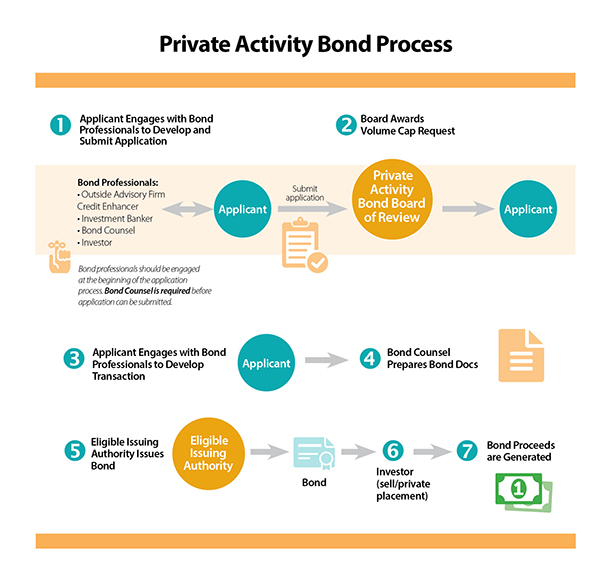

- What is the process of applying for, receiving, and closing on Private Activity Bonds?

- What are the Benefits of Exempt Facility Bonds?

- The major advantage is a lower interest rate on financing compared to a taxable bond or conventional financing.

- Example: investor in 25% tax bracket receives same after-tax income from tax exempt bond at 6% interest compared to taxable bond at 8% interest.

- Long-term capital is available at 100 to 300 basis points (1 to 3 percentage points) less than market rates for periods of 20-40 years.

- The major advantage is a lower interest rate on financing compared to a taxable bond or conventional financing.

- How does a local community benefit from having a PAB Funded Exempt Facility?

- Long-term creation and/or addition of new jobs with above average wages.

- Financial profits produced by the construction of the project.

- Dollars spent in local businesses.

- Additional tax revenues generated.

- What are the Limitations of Tax-Exempt Financing?

- Nationwide Limitation on Outstanding Tax-Exempt Bonds of $40 million.

- Applies to project owner and other principal users.

- Proposed issue, plus the principal of any outstanding Qualified Small Issues or tax-exempt issues for exempt facilities, whenever or wherever they were issued.

- All prior issues are counted nationwide; not just the ones in the same jurisdiction of a proposed project.

- No time period limitations.

- Nationwide Limitation on Outstanding Tax-Exempt Bonds of $40 million.

- What can be financed with Tax-Exempt Bond Proceeds?

- Proceeds can be used for the following purposes:

- New construction of facility.

- New Equipment and fixtures used in production lines.

- New Machinery.

- Land, Landscaping (not to exceed 25%).

- Issuance costs (not to exceed 2%).

- Cost of architects, engineers, attorneys, permits (limited amounts).

- Bond proceeds cannot be used to refinance debt, inventory, or operating capital.

- Can Eligible Project Costs be Paid Prior to the Bond Issuance Date?

- Eligible project costs may be paid prior to the date the bonds are issued if:

- Issuer of the bonds (the tax-exempt entity, not the company) takes “official action,” typically in the form of an “Inducement Resolution” or “Declaration of Intent.”

- “Official Action” must be taken within 60 days after eligible project expenditures are paid.

- Exceptions to 60 day requirement:

- “Preliminary Expenditures” – not in excess of 20% of bond proceeds (architectural, engineering, surveying, construction, project rehabilitation, other land acquisition, site preparation, beginning construction costs, etc.

- “Official Action” does not need to be taken if expenditures do not exceed the lesser of $100,000 for any issue or 5% of the issue proceeds.

- Eligible projects costs cannot be paid from bond proceeds if it was paid for:

- More than 18 months after the later of the following dates:

- When the financed facility was placed in service OR

- The reimbursed cost was paid.

- More than three (3) years prior to receiving volume cap allocation.

- More than 18 months after the later of the following dates:

- How Does the Financing Work?

- Applicants are responsible for arranging the necessary financing steps, including a buyer for the bonds. PAB is not a fiscal advisor or an authorized issuer of tax-exempt bonds.

- Applicants are encouraged to have financing completed at the time of application submission.

- Applicant must detail status of the project’s financing at the time of application.

- Applicants are responsible to provide complete, accurate and verifiable information.

- PAB staff may contact lender to verify financing information.

- What other steps are involved in a Tax-Exempt Bond Transaction?

- Selection of bond counsel.

- Selection of investment banker or if private placement, buyer of the bonds.

- Detailed commitment letters from all financial entities involved.

- Opinion letter from bond counsel stating project qualifies for PAB.

- Why use Private Activity Bonds

- Lower Interest Rates than conventional loans of comparable maturity.

- Higher Loan Amounts (greater leverage) due to lower interest rates.

- Greater Variety of Financing Tools

- Variable Rate Demand Bonds to provide greater cash flow.

- Derivative products to customize financing to desired risk tolerance.

- Equity from 4% Low-Income Housing Tax Credits (LIHTC) for MF Housing projects.

- Provides 25% to 30% more capital as a source of funds.

- How Does the Financing Work?

- Applicants are responsible for arranging the necessary financing steps, including a buyer for the bonds. PAB is not a fiscal advisor or an authorized issuer of tax exempt bonds.

- Applicants are encouraged to have financing completed at the time of application submission.

- Applicant must detail status of the project’s financing at the time of application.

- Applicants are responsible to provide complete, accurate and verifiable information.

- PAB staff may contact lender to verify financing information.

- Who is a part of the applicant’s transaction team?

- The applicant’s transaction team includes (but is not limited to):

- Issuer

- Issuer’s Counsel/Financial Advisor

- Bond Counsel

- Owner

- Owner’s Counsel

- Owner’s Financial Advisor

- Credit Enhancer

- Credit Enhancer’s Counsel

- Construction Phase Credit Enhancer and Counsel

- Tax Credit Equity Provider and Counsel

- Underwriter

- Underwriter's Counsel

- Trustee and Trustee’s Counsel

- Rating Agency

- The applicant’s transaction team includes (but is not limited to):

- What are types of bond issues?

- Public Offering

- Sale to the general public through the marketplace.

- Buyer of the bonds may resell them to other investors.

- Must be rated by one of the three bond rating services – Moody’s, Standard and Poor’s or Fitch’s with AA- or AAA-rating for best interest rates.

- Private Placement

- Sold to bondholder(s); stays in their own investment portfolio.

- Bond does not need to be rated; due diligence done by investor.

- No need for Credit Enhancement. Interest rate may be higher.

- No need for Trustee or Underwriter.

- Transaction:

- Takes less time;

- Has fewer hurdles; and

- Is often less expensive to structure.

- Public Offering

- What is the work and costs associated with private bond issuance?

- Bond issues involve a substantial amount of work by many parties.

- Costs related to transaction can be substantial, including fees for: application, underwriter, underwriter’s counsel, bond counsel, credit enhancement, construction lender, permanent lender, real estate counsel, issuer, and trustee.

- Out of pocket expenses for any of the foregoing, printing costs, rating service costs, etc.

- Why should manufacturers use tax-exempt bonds?

- State and Federal laws allow manufacturing companies to use a city or county’s name and tax-exempt financing status to issue tax-exempt bonds.

- If all tax requirements are met, bond issues are exempt from federal income taxes and possibly state and local taxes.

- Interest rates of tax-exempt bonds are usually lower than taxable bonds.

- There is no guarantee, debt, liability, obligation or pledge of faith by the city or county issuing the bonds.

- Governmental entities are willing to do this because PABs meet a public purpose or create a public benefit, i.e. creation of jobs from a new manufacturing facility.

- Tax-exempt bonds provide an alternative, low-cost, source of funds to finance capital expenditures.

- Why should developers use tax-exempt bonds?

- Lower interest rates than conventional loans of comparable maturity.

- Higher loan amounts (greater leverage) due to lower interest rates.

- Access to a greater variety of financing tools.

- Variable rate demand bonds to provide greater cash flow.

- Derivative products to customize financing to desired risk tolerance.

- Provides 25 percent to 30 percent more capital as a source of funds.

- Access to equity from 4 percent Low-Income Housing Tax Credits (“LIHTCs”).

- Provides 25 percent to 30 percent more capital as a source of funds

- Easier and quicker path to obtain necessary authorization to process