-

- Overview

-

- Emergency Food Assistance

- HEAT

- HEAT Forms

- Local HEAT Offices

- Home Electric

- Home Gas

- Shut-Off Protection

- Energy and Water Tips

- Resources

- Earned Income Tax Credit

- Overview

-

- Navajo Fund

- Subdivision Ordinance Consultant Pool

- Uintah Basin Fund

- Overview

-

- Section 8 Landlord Incentive

Private Activity Bond Program

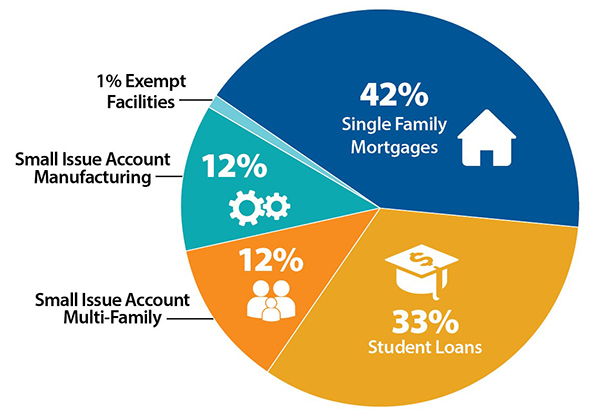

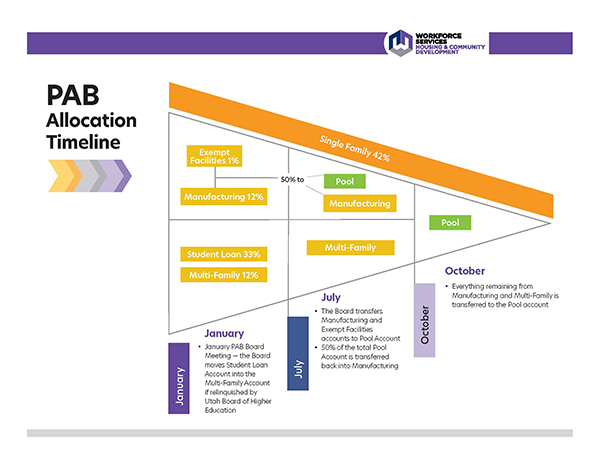

The Private Activity Bond (PAB) Program is Utah’s tax-exempt bonding authority creating a lower cost, long-term source of capital under the Federal Tax Act of 1986. The Federal Government allocates over $37 billion per year to states on a per capita basis. Each state establishes its usage priorities by statute. The Utah State Legislature has distributed our volume cap into the various allotment accounts listed below:

Allocation

Please contact the PAB Program Manager for current information regarding totals for each account. Throughout the year the remaining volume cap decreases as applications are awarded volume cap. The totals of the accounts at the beginning of the year for the past three years were as follows:

2024 2023 2022 2021 2020 Multi-Family $51,266,010 $48,683,520 $44,061,270 $42,898,403 $39,829,923 Manufacturing $51,266,010 $48,683,520 $44,061,270 $42,898,403 $39,829,923 Exempt Facilities $4,272,167 $4,056,960 $3,671,773 $3,574,867 $3,319,160 Student Loans $140,981,527 $133,879,680 $121,168,493 $117,970,608 $109,532,288 Single Family $179,431,035 $170,392,320 $154,214,445 $150,144,410 $139,404,731

Meeting Schedule

The Private Activity Bond Authority Board Meetings are held five times during the year, generally on the second Wednesday of the scheduled month and begin at 9 a.m.

If you wish to receive PAB agendas, please subscribe to the Board via The Utah Public Notice Website. If you wish to view previous PAB agendas, please view them via The Utah Public Notice Website by searching previous meeting dates.

Private Activity Bond Program Policies

For detailed account information please see the Private Activity Bond Program Policies Manual here.

Board Members

- Kamron Dalton - Governor's Office of Economic Development, Managing Director of Operations

- Kirt Slaugh - State of Utah Treasurer’s Office, Chief Deputy State Treasurer

- Nathaniel Talley - Utah Board of Higher Education, Chief Financial Officer

- David Damschen - Utah Housing Corporation, President & Chief Executive Officer

- Amelia Powers Gardner, Utah County Commissioner

- Nicole Rosenberg - Iron County, Treasurer

- Chip Dawson - South Jordan City, City Treasurer

- Dean Lundell - Lehi City, Finance Director

- Heidi Voordeckers - North Salt Lake, Finance Director

Staff Contact:

Jenn Schumann

Private Activity Bond Program Manager

Cell: 385-584-9716

Address: 140 East 300 South, Salt Lake City, Utah 84111