-

- Overview

-

- Emergency Food Assistance

- HEAT

- HEAT Forms

- Local HEAT Offices

- Home Electric

- Home Gas

- Shut-Off Protection

- Energy and Water Tips

- Resources

- Earned Income Tax Credit

- Overview

-

- Navajo Fund

- Subdivision Ordinance Consultant Pool

- Uintah Basin Fund

- Overview

-

- Section 8 Landlord Incentive

Moderate Income Housing and Reporting

Each year, certain cities and counties are required to report on the Moderate Income Housing (MIH) element of their general plan. In the first year, they submit an initial report that updates this section and outlines the strategies they plan to implement. In subsequent years, they provide follow-up reports detailing the progress they've made on those strategies.

MIH Reporting Form

Complete reporting for 2025 via this form:

2025 MIH Report

The Reporting will open on May 1. If you want to see a preview of the 2025 MIH Report questions, go to the Questions & Support section below for a link to the questions.Reporting Due

August 1st @ 11:59 pm. Late reports will not be accepted.

Communities Required to Submit

Cities: All cities over 10,000 population; cities over 5,000 in counties with at least 40,000 in population.

Counties: Those over 40,000 population with at least 5,000 in unincorporated population.Based on this criteria, the following cities and counties will be required to report in 2025:

CITIES

Alpine

American Fork

Bluffdale

Bountiful

Brigham City

Cedar City

Cedar Hills

Centerville

Clearfield

Clinton

Cottonwood Heights

Draper

Eagle Mountain

Enoch

Farmington

Farr West

Fruit Heights

Grantsville

Harrisville

Heber

Herriman

Highland

Holladay

Hooper

Hurricane

Hyde Park

Hyrum

Ivins

Kaysville

Kearns

Layton

Lehi

Lindon

Logan

Magna

Mapleton

Midvale

Millcreek

Murray

Nibley

North Logan

North Ogden

North Salt Lake

Ogden

Orem

Park City

Payson

Perry

Plain City

Pleasant Grove

Pleasant View

Providence

Provo

Riverdale

Riverton

Roy

Salem

Salt Lake City

Sandy

Santa Clara

Santaquin

Saratoga Springs

Smithfield

South Jordan

South Ogden

South Salt Lake

South Weber

Spanish Fork

Springville

St. George

Sunset

Syracuse

Taylorsville

Tooele

Tremonton

Vernal

Vineyard

Washington

Washington Terrace

West Bountiful

West Haven

West Jordan

West Point

West Valley City

White City

Woods Cross

COUNTIES

Box Elder County

Cache County

Iron County

Salt Lake County

Summit County

Tooele County

Utah County

Washington County

Weber County

MIH Reporting Content

Initial Report: required in the first year that a community is required to report AND any year that a community changes their strategies or ways they implement them. Initial reports should include:

- Each MIH strategy the community will implement.

for municipalities, refer to Utah Code 10-21-201, Section (3)(a)(iii); for counties, refer to Utah Code 17-80-201, Section (3)(a)(ii)

- How the community plans to implement each MIH strategy.

For each strategy, list benchmarks (key task(s) to advance this strategy, which should be specific and measurable) and planned implementation timeline(s) (which should be time bound (e.g., annually, quarterly; Q1, Q2; 2025, 2026, 2027; specific dates; etc.))

Subsequent Progress Report: required in the years following the initial report. Subsequent progress reports should include:

- Progress on each MIH strategy in the previous 12 months.

- Land use regulations and/or decisions made by the community in the previous 12-months to implement their MIH strategies.

You may include actions taken before the 12-month reporting period as an ongoing action if it:

-

- Clearly supports the moderate income housing strategy from the initial report (e.g., previously adopted ordinance, approved a land use application, made an investment, or approved an agreement or financing);

- The new report shows the action is still helpful to making progress on the strategy.

- Barriers encountered in the previous 12 months to implement their MIH strategies.

Note that documenting barriers does not exempt the community from reporting plan progress. The minimum required number of strategies must advance for compliance, regardless of the barriers faced.

- Number of internal, external and detached Accessory Dwelling Units (ADUs).

- Number of residential dwelling units that have been entitled but have not received a building permit as of the report’s submission date.

Entitled units are units that are legally allowed to be built under current zoning, existing development agreement, or other legal mechanism, (e.g., overlay zone). This data is collected to capture current built or zoned conditions. Please report entitled unit data as of May 1, 2025.

Do not include any parcels or units that are only planned or in the process of being rezoned as residential. Example: if a parcel is zoned greenbelt on May 1, 2025 and a rezone application is in process, do not count it in this data.

If some parcels can’t be developed due to barriers like geography, setbacks, or lack of infrastructure, you can explain these issues in the barriers or narrative sections of your report.

- Shapefiles or links to current maps/tables related to zoning.

These will be uploaded securely via Virtru, from a link in the survey.

- How the market has responded to your MIH strategies, including the number of entitled MIH units or similar data. (e.g., units permitted, units entitled, deed restrictions, rezones, households displaced during redevelopment, changes in rents, etc.).

- Any recommendations on how the state can support the specified municipality in implementing the moderate income housing strategies.

Number of Strategies Required

Using Current Strategies

Compliance

Priority Consideration

County

3

5

Municipality without a fixed guideway transit station

3

5

Municipality with a fixed guideway transit station

5

6

Using New StrategiesCounty

1

5

Municipality without a fixed guideway transit station

1

5

Municipality with a fixed guideway transit station

3

6

Priority Consideration

Priority consideration for the Transportation Investment Fund of 2005 and the Transit Transportation Investment Fund is available for communities which surpass the minimum number of strategies in their general plan element and annual progress report.

Fixed Guideway Transit Station

These are public transit facilities that use rail for public transit or a separate right-of-way for public transit, such as bus rapid transit systems. If your community has this, to be compliant, you must include in your strategies: strategy U, and either strategy G, or H, and three more strategies OR strategy U, one from X–CC, and one other strategy. For priority consideration, you will need 6 total strategies, including those options above.

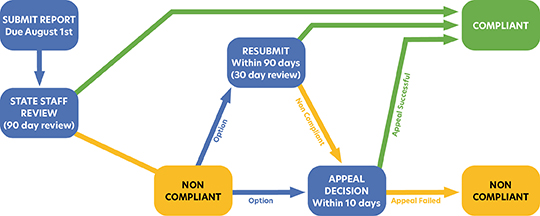

Reporting Review & Appeal Process

SUBMIT REPORTS

MIH Reports are due on August 1st @ 11:59 pm. Late reports will not be accepted.STATE STAFF REVIEW

The Housing & Community Development Division will then have 90 days to review the report. The division will review and determine if the report is compliant or non-compliant. After reviewing a report, the division will provide notice as provided in Section 10-21-202 or 17-80-202 of Utah Code.IF COMPLIANT

The community can continue working towards the goals in their plan and report the next year (unless they used one of the new strategies, upon which they wouldn’t need to report for two additional years).IF NON-COMPLIANT

If the report is non-compliant, the reporting entity may either submit a corrected report or request an appeal of the determination.RESUBMIT

If they choose to submit a corrected report, it must happen within 90 days from when the notice is sent. The division will review the corrected report within 30 days after the report is received.APPEAL

If your community wants to appeal a notice of non-compliance, you must send a written request within 10 days of when the notice was sent. The appeal must include your community’s name, a representative’s signature, and the reason for the appeal. You can send it by email, fax, mail, courier, or hand-delivery.Once the appeal is received, the division will work with other organizations to form an appeal board. You can submit more information or arguments within 15 calendar days of your appeal, but it must relate to either the 12-month reporting period or your compliance strategy.

If you decide to cancel the appeal, you must send a written notice at least seven days before the appeal board’s first meeting. If you withdraw, your community will still need to fix the issue within the original 90-day correction period.

For full details, please refer to the administrative rule below.

Penalties for Non-Compliance

Communities that do not submit their MIH report are ineligible for:

- Transportation Investment Fund of 2005 & the Transit Transportation Investment Fund.

- State Tax Commission Distribution of Sales and Use Tax to fund Highways.

- Non-compliant communities pay a $250/day penalty fee and $500/day for a second consecutive year of non-compliance (Utah Code 10-21-202 and 17-80-202)

Supporting Laws & Policies

- For municipalities: Utah Code 10-21-202 explains the required contents of MIH reports, and Utah Code 10-21-201 explains MIH elements needed in a General Plan and lists MIH strategies.

- For counties: Utah Code 17-80-202 explains the required contents of MIH reports, and Utah Code 17-80-201 explains MIH elements needed in a General Plan and lists MIH strategies

* reflects recent re-numberings made on November 6th, 2025 to Utah Code regarding MIH.

Administrative Rule - Review Process for Plan for Moderate Income Housing Reports

Recent Legislative Changes

HB37 (Utah Housing Amendments) adds new MIH “submenu” strategies promoting affordable homeownership that offer the following advantages:

- If a municipality without fixed guideway stations uses one of the new strategies, it counts as three normal MIH strategies, and the municipality shall be considered compliant for the base year AND two subsequent reporting years.

- If a municipality with fixed guideway stations uses one of the new strategies, they can implement at least three strategies to achieve compliance instead of five.

- If a county uses one of the new strategies, they can implement at least one strategy to achieve compliance instead of three. Also, the county shall be considered compliant for the base year AND two subsequent reporting years.

New MIH strategies: for municipalities, refer to Utah Code 10-21-201, Section (3)(a)(iii); for counties, refer to Utah Code 17-80-201, Section (3)(a)(ii):

- Create a housing and transit reinvestment zone (HTRZ)

- Create a home ownership promotion zone (HOPZ)

- Create a first home investment zone (FHIZ)

- Approve a project that receives funding from, or qualifies to receive funding from the Utah Homes Investment Program

- Adopt or approve a qualifying affordable home ownership density bonus for single-family residential units.

- Adopt or approve a qualifying affordable home ownership density bonus for multi-family residential units.

Prior Reports

SB 34 Municipal Progress Summaries

Other Resources

State

The Utah Housing Affordability Dashboard - In collaboration with the Kem C. Gardner Policy Institute, a Utah Housing Affordability Dashboard has been created which identifies moderate and affordable housing needs, supply, and a 5-year projection across Utah communities with populations greater than 5,000 people.

‘Utah Housing Strategic Plan’ Dashboard - In May 2025, Utah Governor Spencer Cox unveiled a new housing dashboard to go along with the efforts of the Utah Housing Strategic Plan, which will be released in December 2025.

Land Use Strategies to Bring Housing Back Within Reach - A 2024 report by Envision Utah on best practices to reform zoning and housing regulations, with the ultimate goal of increasing housing attainability and affordability in Utah.

‘How Do We Make Housing Affordable?’ - a 9-minute video produced by Envision Utah describing land use and construction regulation barriers to affordable housing and recommendations for potential changes to facilitate more affordable housing.

Moderate Income Housing (MIH) Element Model Resolution - a model resolution that communities can use to amend and adopt a moderate-income housing element in their General Plan.

‘A Profile of Affordable Housing Programs and Funding in Utah, FY 2022’ - a report by the Kem C. Gardner Policy Institute, which profiles nearly 30 programs that provided hundreds of millions of dollars in housing assistance to Utah homeowners and renters in FY 2022.

Federal

The American Community Survey (ACS) - an extensive annual household survey produced by the U.S. Census Bureau which provides several tables of demographic and housing data on its website.

Comprehensive Housing Affordability Strategy (CHAS) – datasets from the U.S. Department of Housing & Urban Development (HUD) that organize housing needs according to household income and program eligibility limits.

Questions & Support

If you need any assistance submitting your MIH report or have questions about MIH reporting requirements,

- See a Preview of the 2025 MIH Report questions, so you can prepare your answers before filling out the report online.

- Watch this Walkthrough Video or access the Walkthrough Slides.

- Watch a recording of the MIH Webinar from June 23rd, 2025, which was hosted in partnership with APA Utah and the Utah League of Cities and Towns (ULCT).

- Visit our Frequently Asked Questions (FAQs) page.

- Look at this Informational Flyer.

- Email mih@utah.gov.

- Call Todd Andersen (MIH Program Specialist) at (385) 290-9717.

For other assistance, contact Meg Ryan from Utah League of Cities and Towns (ULCT) at mryan@ulct.org.